Well well well.

So much happened during last months. At the end we had new all time high that is currently… fading. (click on the picture to enlarge)

There are many reason for it; the German economy is marching at full steam. The ECB however is starting to signal a reduction of its massive QE. The market doesn’t like it and starts showing.

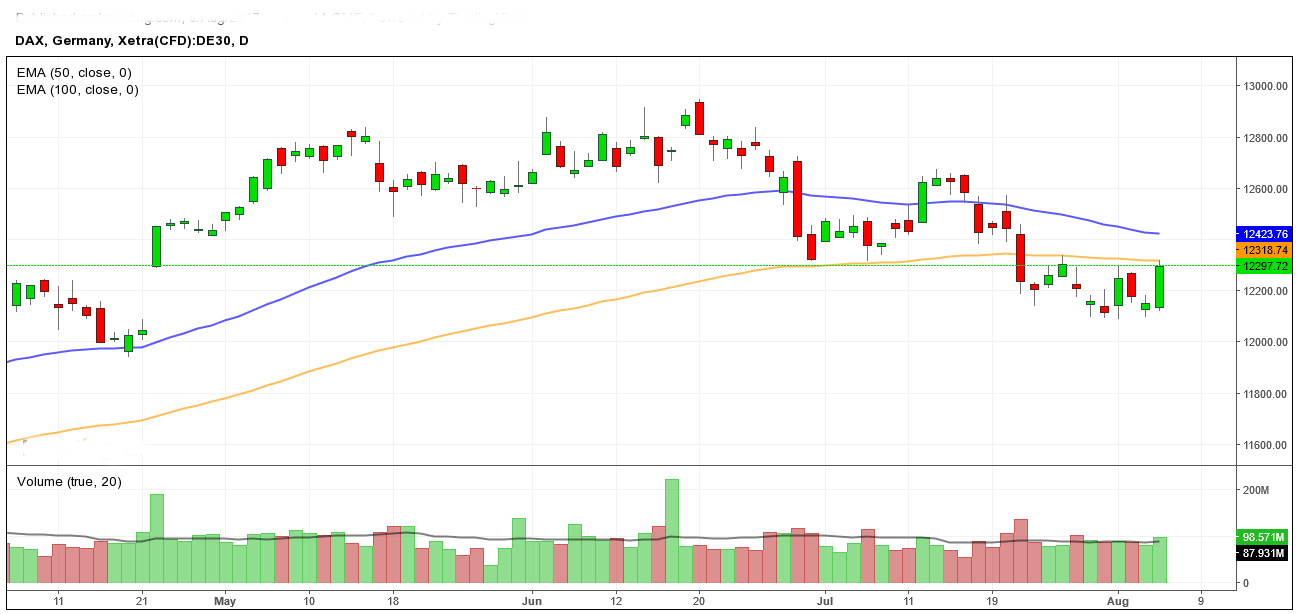

Looking at the chart we notice that since the all time high last July the index has started a downturn trend, breaking the 50D MA . This triggered a bearish tone that intensified when DAX crossed the 100 DMA that wasn’ t been violated since last year and that at now is acting as resistance (see Fridays action were the 100 Days moving average was rejected). Next week probably DAX will try to cross the latter, and possibly the 50 DMA to reverse course. I think that this is unlikely in the short and medium term, but time will tell. The level to watch for a breakdown to 12000 is 12100 that has already shown to be a strong support (so far).

For the time being I am bearish on the index and i will short anything under the 50 D MA at levels between 12320 to 12420 with SL over 12450 . My long term vision is extremely bearish and I will cover it in a following post.