Category: Dax

Waiting for the next move

Posted by truman52000 | Apr 26, 2020 | Dax | 0

A bear market is in

Posted by truman52000 | Mar 14, 2020 | Dax | 0

Why this move might not end soon

Posted by truman52000 | Nov 9, 2019 | Dax | 0

Dax update week ending 18 October 2019

Posted by truman52000 | Oct 19, 2019 | Dax | 0

Dax scenarios on this interesting spot

Posted by truman52000 | Oct 13, 2019 | Dax | 0

MFI divergence looks unsustainable.

by truman52000 | Jun 28, 2020 | Dax | 0

That was a long bull run. Totally unexpected. Totally fostered by the continuos huge amount of liquidity central banks have poured in trying to keep the ball rolling. P/E on WS are again unsustainable at current prices.

Read MoreWaiting for the next move

by truman52000 | Apr 26, 2020 | Dax | 0

Central banks are inundating markets with fresh and abundant money. This is obviously distorting the market but here we go.|

Read MoreA bear market is in

by truman52000 | Mar 14, 2020 | Dax | 0

Everything is changed and Dax and several others indices entered in a bear market and for good.

We are experiencing very high levels of volatilility with the Dax topping 1000+ pips a day.

Things will calm down but this wouldn’t mean a rapid recovery. At all.

Why this move might not end soon

by truman52000 | Nov 9, 2019 | Dax | 0

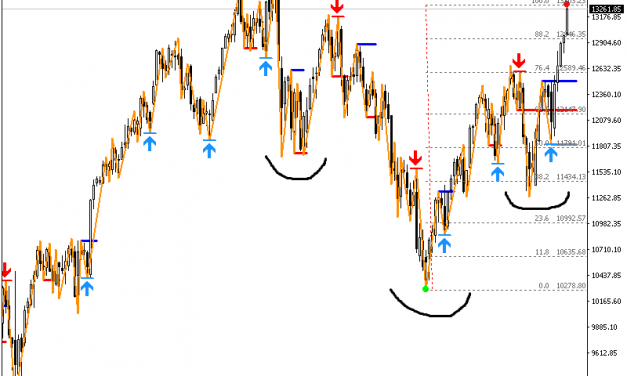

As most traders know, markets doesn’t move in straight lines but in waves. For any timeframe you pick the moves of the market are based on this continuos rises and falls. Moves are quite random, but can be “structured” to see the trend (HH and HL for an uptrend for example and viceversa).

Read MoreDax update week ending 18 October 2019

by truman52000 | Oct 19, 2019 | Dax | 0

A quick update on DAX

Read MoreDax scenarios on this interesting spot

by truman52000 | Oct 13, 2019 | Dax | 0

Another week is gone and price is now in a very interesting spot if we put it into perspective. Forget about macroeconomic, fundamentals , politics and the alike. Let’s have a look at the charts from a distance.

Read MoreUnprecedented detachment from reality.

by truman52000 | Jul 6, 2019 | Dax, Dow | 0

This week ended with Wall Street printing a series of all times high on all three major indices. Cool right?

If an alien just arrived in the USA he would think that the economy there is roaring at full speed. Probably expecting rather normal interest rates at around 5%, a wealth distributed on a large part of the population and so on.

Wait as this is not the case. The FED signaled a very probable rate cut from current (low) 2.5% on the next meeting at the end of July as the american economy showed signs of tiredness with several macros indicators deteriorating fast.

Target reached.

by truman52000 | Jun 2, 2019 | Dax, Dow | 0

Charts speak better and louder then 1000 words. All the main american indices including NASDAQ are...

Read MoreBears are going to be in charge soon

by truman52000 | May 23, 2019 | Dax, Dow | 4

Great month May for me. I am an old school trader and sell in May worked as a charm… I will...

Read MoreThe power of technical analysis

by truman52000 | Dec 25, 2018 | Dax, Dow | 0

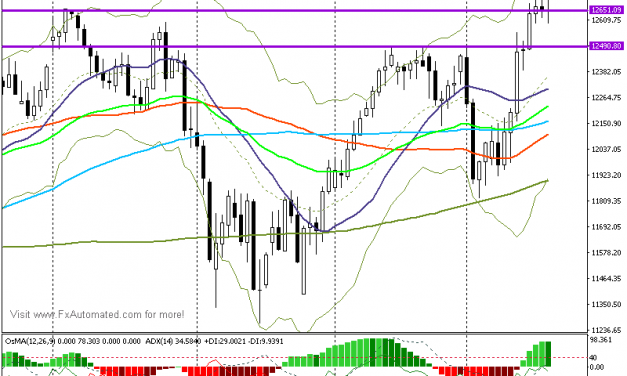

I think is just about time to explain why TA (technical analysis) works regardless of the naysayers and fundamental analyst that try to evaluate the “intrinsic” value of a security. Take as example my latest post on DAX analysis (14 October 2018) where succesfully have “predicted” the fall of the index having as target 10300 that will probably reached in the next few days

Read MoreDax and SeP (guest post)

by truman52000 | Nov 25, 2018 | Dax | 0

This week I am featuring a couple of charts from Aaron that has been a interesting contributor in the past.

The first chart showing how the Dax30 broke below the wedge and was rejected from the 200DMA.

DAX update (and is not pretty)

by truman52000 | Oct 14, 2018 | Dax | 0

Just a quick update for a meaningful Dax movement I was expecting for. The head and shoulder pattern unfolded breaking the neckline at 11700 and at the same time a medium term upward channel (1).

Read More

Free resource (PDF)

About us

This site is devoted to share ideas and strategies/ trends on different markets. A contribution is welcome regarding main indices or commodities.I mostly cover DAX, Gold and US indices. However I will analyze any other index or share at my will as I use my own methods, my own ideas and my own money.