After a very long break I am back and with a bang.

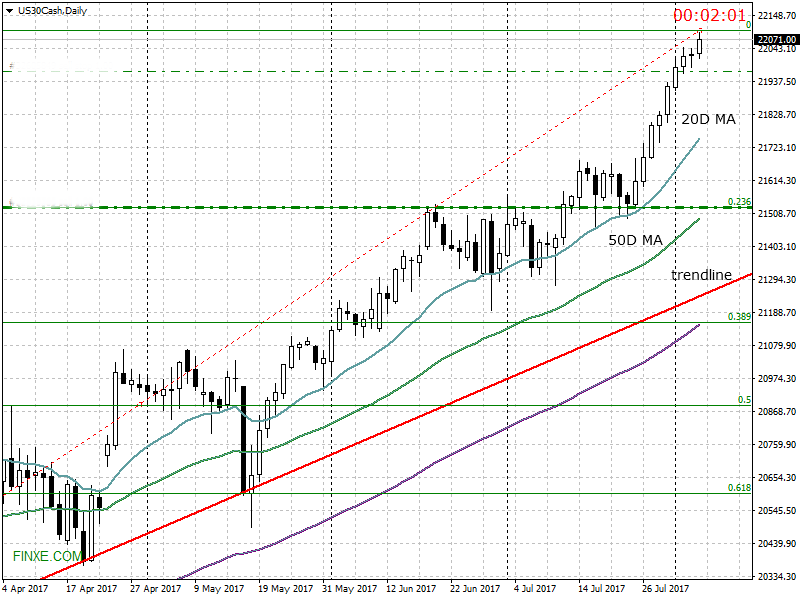

I decided to have a look at the Dow Jones chart , and just one word comes to my mind: AMAZING.The DOW is showing green candles after green candles and eight all time high close in a row. It passed the 22000 mark with ease. Nothing seems to stop it: economical data, Fed starting to tight, political uncertainty, Korea.

RSI is overbought at daily, weekly and monthly levels. As soon as it gets nearer to the 20DMA it just has all the dips bought and up we go.

I should add that this is not a normal behaviour for any market and I really do not know for how long this is sustainable. We had a week of earnings that showed some decent performance, but nothing more. What is even more scary is the level of complacency with the VIX falling to an all time low under 9.

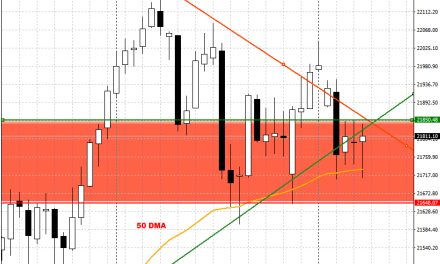

Getting more technical the market is still on bullish mode. There is no hint on any timeframe for a reversal in sight. Summer should lower the already tiny volumes. No volatility, no market tantrums on sight. The trend is still your friend and unless something external happens, the Dow is a buy.

Possibly when the market makers will decide to sell, we will see a quite deep (and fast) correction. The obvious level to watch for is obviously the 22000. The trend line is quite far and for the time being I am neutral/bullish and waiting for a decisive move under 22000 followed by 21500 before entering short.