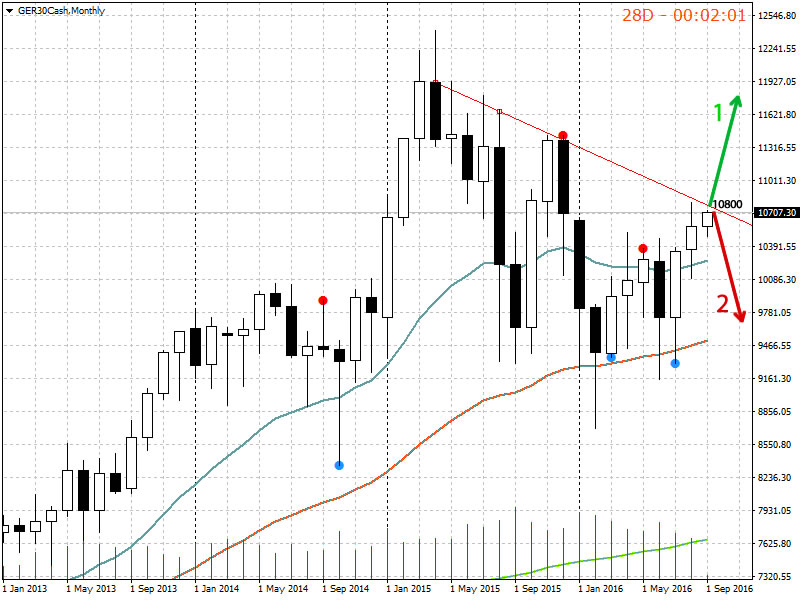

If you check the graph above showing the monthly DAX 30 candlesticks, you will notice that the index is on a downtrend since the top in April 2015 at 12374 points. The red line showing the trend has been briefly crossed five times so far and always the index has been rejected from it.

As we are approaching again this trendline we have to scenarios I have imagined.

- The index cross it and continue strongly its race to the 12000 mark.

- The index is again rejected and falls back to the 10000 level ( and further down).

Difficult to say but my opinion is on the bearish side. This because of a look at the wider economical and cyclical picture is not encouraging and September has been historically a bad month for the stock markets.In this case at around the 10800 mark is possible a reversal of the current short term uptrend. If the movement would be strong enough crossing the 10320 down under the 10K level, we might see a lot of bearish pressure.

The opposite would happen id the Dax succesfully reaches the 11000 points were the bulls would probably pull it up to 12000. August slow motion trading is past and September will be pivotal for Dax future trend.

Details of the the same graphs on a shorter timeframes (weekly and daily) are below.

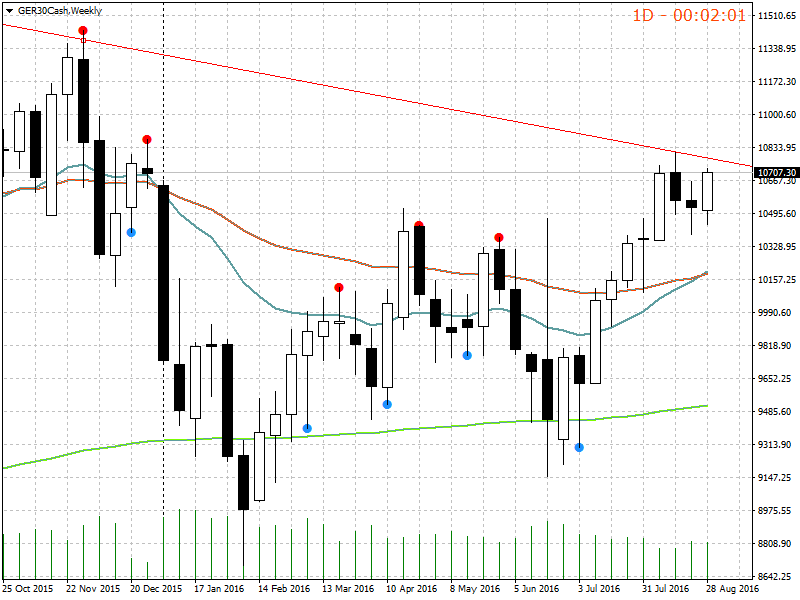

Weekly chart

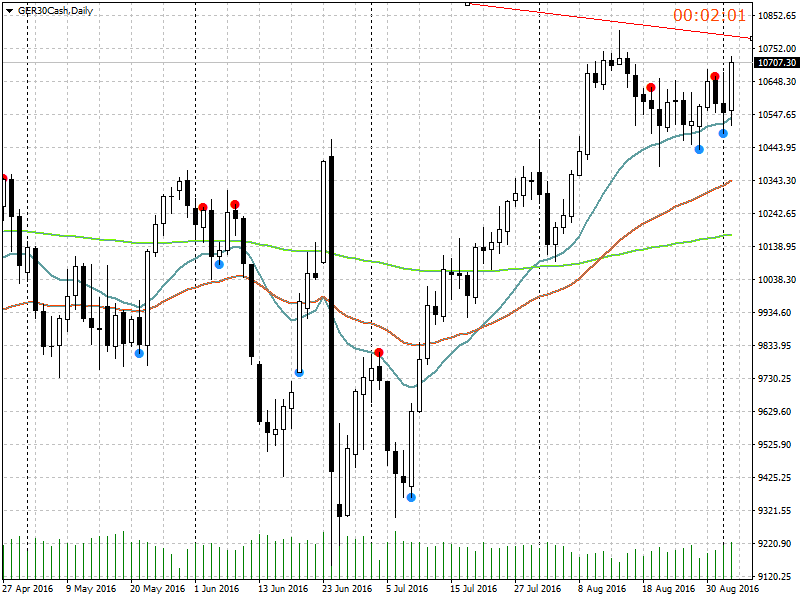

Daily chart

Here is the detail for Friday’s session. Dax found support at the weekly pivot forming a doji that had confirmation on next candle for the uptrend to the end of session.

We are bullish for the short term, and are waiting confirmation on the 10800 level to check if the uptrend will continue or reverse.

Other perspectives

Other ideas included from other sources follows

BEARISH The chance in this graph is a raise to 10740 (78.6 Fibonacci-) max then going down

BULLISH not many bullish examples at this date…