That was a long bull run. Totally unexpected. Totally fostered by the continuos huge amount of liquidity central banks have poured in trying to keep the ball rolling. P/E on WS are again unsustainable at current prices.

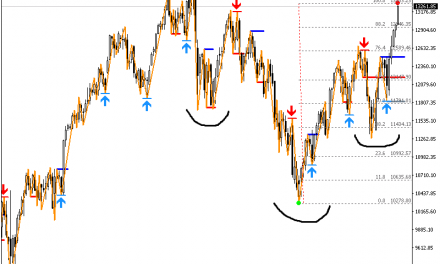

Looking at the Dax there is a great divergence on the Money Flow Index that just can’t be ignored. The chart still showing ascending/ ranging candles on the daily while the MFI is going to cross the oversold level!

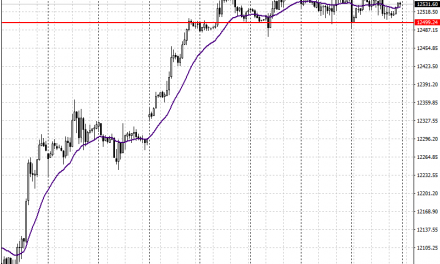

The 200 DSMA has been violated; needless to say I am short and bearish and expect soon a pickup on volatility and ATR values currently still at a respectably high 400.

Next important support level at 11850 area and I am not sure for how long it will hold as a test of the 50 DSMA is due..