Tag: dax

A bear market is in

Posted by truman52000 | Mar 14, 2020 | Dax | 0

Why this move might not end soon

Posted by truman52000 | Nov 9, 2019 | Dax | 0

Unprecedented detachment from reality.

Posted by truman52000 | Jul 6, 2019 | Dax, Dow | 0

Target reached.

Posted by truman52000 | Jun 2, 2019 | Dax, Dow | 0

The power of technical analysis

Posted by truman52000 | Dec 25, 2018 | Dax, Dow | 0

MFI divergence looks unsustainable.

by truman52000 | Jun 28, 2020 | Dax | 0

That was a long bull run. Totally unexpected. Totally fostered by the continuos huge amount of liquidity central banks have poured in trying to keep the ball rolling. P/E on WS are again unsustainable at current prices.

Read MoreA bear market is in

by truman52000 | Mar 14, 2020 | Dax | 0

Everything is changed and Dax and several others indices entered in a bear market and for good.

We are experiencing very high levels of volatilility with the Dax topping 1000+ pips a day.

Things will calm down but this wouldn’t mean a rapid recovery. At all.

Why this move might not end soon

by truman52000 | Nov 9, 2019 | Dax | 0

As most traders know, markets doesn’t move in straight lines but in waves. For any timeframe you pick the moves of the market are based on this continuos rises and falls. Moves are quite random, but can be “structured” to see the trend (HH and HL for an uptrend for example and viceversa).

Read MoreUnprecedented detachment from reality.

by truman52000 | Jul 6, 2019 | Dax, Dow | 0

This week ended with Wall Street printing a series of all times high on all three major indices. Cool right?

If an alien just arrived in the USA he would think that the economy there is roaring at full speed. Probably expecting rather normal interest rates at around 5%, a wealth distributed on a large part of the population and so on.

Wait as this is not the case. The FED signaled a very probable rate cut from current (low) 2.5% on the next meeting at the end of July as the american economy showed signs of tiredness with several macros indicators deteriorating fast.

Target reached.

by truman52000 | Jun 2, 2019 | Dax, Dow | 0

Charts speak better and louder then 1000 words. All the main american indices including NASDAQ are...

Read MoreThe power of technical analysis

by truman52000 | Dec 25, 2018 | Dax, Dow | 0

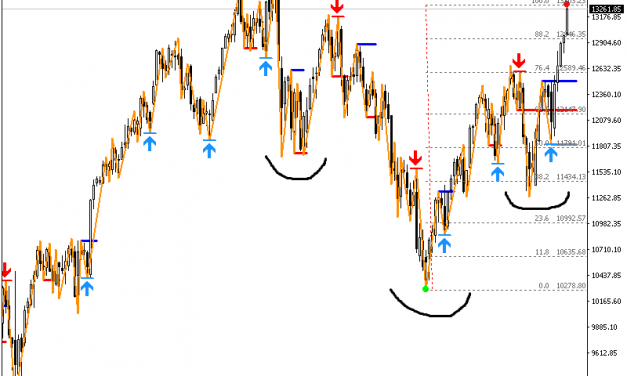

I think is just about time to explain why TA (technical analysis) works regardless of the naysayers and fundamental analyst that try to evaluate the “intrinsic” value of a security. Take as example my latest post on DAX analysis (14 October 2018) where succesfully have “predicted” the fall of the index having as target 10300 that will probably reached in the next few days

Read MoreDAX update (and is not pretty)

by truman52000 | Oct 14, 2018 | Dax | 0

Just a quick update for a meaningful Dax movement I was expecting for. The head and shoulder pattern unfolded breaking the neckline at 11700 and at the same time a medium term upward channel (1).

Read MoreA few levels to keep in mind (DAX-DOW-GOLD)

by truman52000 | May 19, 2018 | Dax, Dow, gold | 0

One of the most important lines to keep well in mind when trading are undoubtebly historical levels of support and resistance that proved to be key signals for a long or short position. A broken resistance or support or a rejection would give a major hint on the direction of a trade. Trading the smaller timeframes having in mind a broader perspective doesn’t hurt at all.

Read MoreDAX possibly regaining some ground next week

by truman52000 | Mar 3, 2018 | Dax | 1

Really a bad week for the DAX, that broke the 12K mark and has been hovering below, and regained the level just on the futures market helped by Wall Street recupering ground in the final hours. Technically the DAX has broken the bearish flag on the daily chart.

Read MoreDax consolidating recent gains

by truman52000 | Oct 15, 2017 | Dax | 0

After some relatively small gain Dax has been ranging in the horizontal tight channel 12930-13000 with some

Read MoreDax at full speed

by truman52000 | Sep 30, 2017 | Dax | 0

September , on average, has been often a dangerous month for the stock market. DAX didn’t care also thanks

Read MoreDax Gann analysis 21 September 2017

by truman52000 | Sep 21, 2017 | Dax | 2

Here is our weekly analysis from Aaron that includes some insight on the methodology.

Read More

Free resource (PDF)

About us

This site is devoted to share ideas and strategies/ trends on different markets. A contribution is welcome regarding main indices or commodities.I mostly cover DAX, Gold and US indices. However I will analyze any other index or share at my will as I use my own methods, my own ideas and my own money.