Here is our weekly analysis from Aaron that includes some insight on the methodology.

How to identify and trade the harmonic fractual moves..

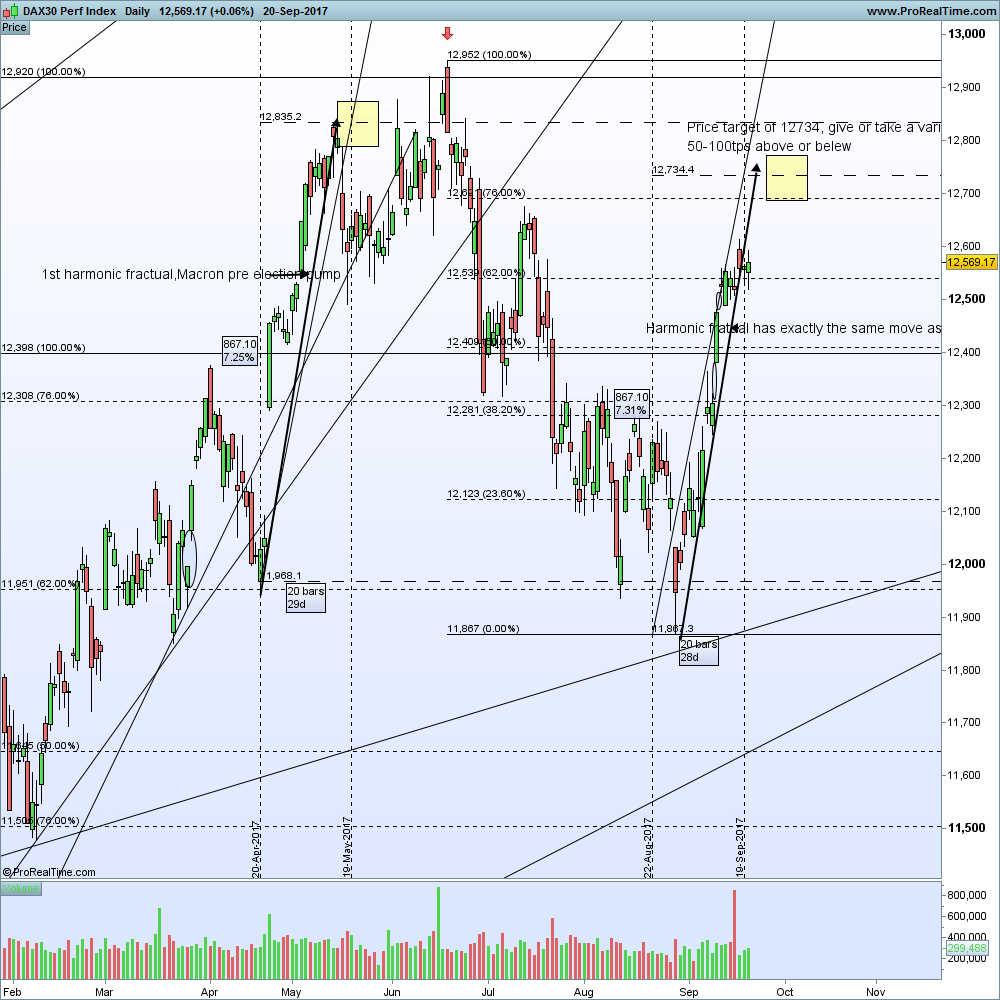

Harmonic fractuals are moves that are identical to previous patterns on a chart. They are bound by a time frame, so those patterns moves will appear on any time frame from the one minute to the monthly.

As we can see on the chart we currently have a harmonic move following the first harmonic from April (Macron post election raise).

How to measure a harmonic– As shown on the chart on the first harmonic I’ve used two ways to measure.

- An arrow from bottom to top

- Ruler

Is noticeable on the chart the second harmonic move currently in formation. By copying both the arrow and ruler we will get a termination point on the second harmonic move. The ruler is an important factor as it will give us both a move in points and percentage.

How to set up a trade

Often is very difficult to identify the formation of an harmonic and most times is probably too late to enter a trade.

I’ve found over the years of trading that the best approach is to wait for the second harmonic to reach it’s termination point, then set up a trade on a correction wave as when the second harmonic is completed a correction move in the opposite direction have to follow.

The second harmonic can either over extend of under shoot the termination point but by not many points as a variance of maximum 50-100 points is expected.

On the daily Dax chart shown – the termination point is at 12,734. The trade set up will trigger a short postion as we know the corrective down move MUST follow. A stop loss should be set above the all time high of 12,952.

Great work Aaron, i was able to understand it with the text that followed the Chart. Is it too much to ask you that in the next weekend update, you could share your target price after the eventual short position is triggered at the Termination Point @12734? Basically is to understand where do you see the Dax going from the Gann Perspective!! It would help with a Chart as well! Thanks Truman and Aaron!!

good question Mario, thank you