This week I will cover something extremely interesting going on on the DOW Jones.

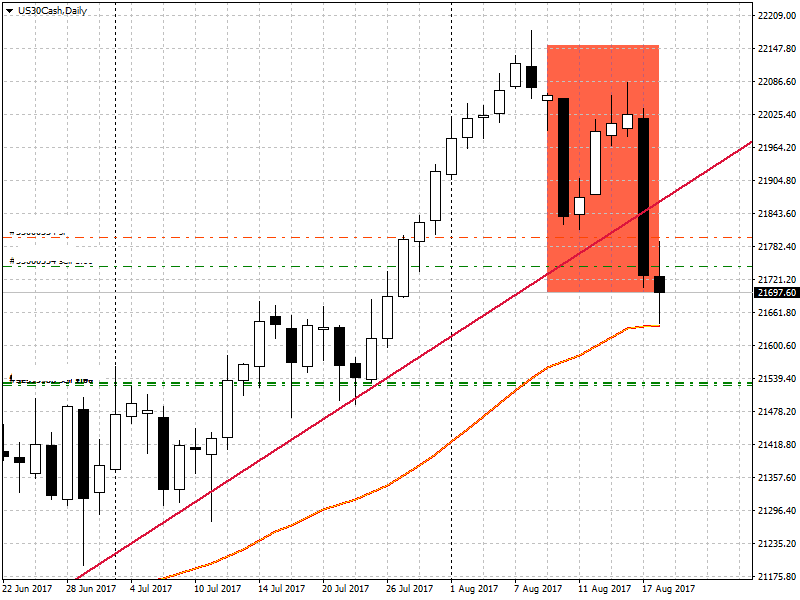

A quite rare but effective candlesticks formation has fully developed on the chart. A falling three methods candlestick pattern. This pattern (in the red box) is composed by a large black candle followed by three (but might be also four or even five) smaller white candles contained within the first bearish candle. In this pattern we will get confirmation to enter the trade when the fifth (in our case sixth) candle is a black one that ends under the first long bearish candlestick. Et voila, just what we have on our daily chart.

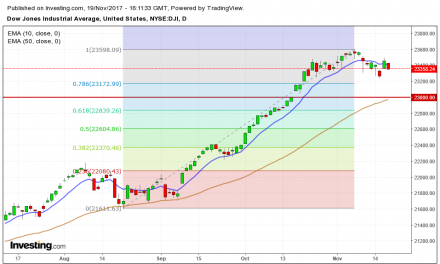

The great investor and analyst Bulkowski explains in his website that after this kind of pattern follows a bearish confirmation 71% of times (and the direction has been confirmed as we had another black candle that even touched the 50 days moving average). He also adds”The average move [down] is a rather robust 4.58% in 10 days, where a good move would be 6% or more.”. So if we take a conservative approach we should see a correction of around 4-5% in the next ten days meaning a 1000 points fall to around the 20700 area. This is where I will set my first take profits. On top of this formation there are several other indicator showing how a meaningful movement downward is in the cards. Time will tell. I am obviously bearish on the short and medium term.