Another week is gone, and we find the DOW a couple of hundreds points below were we left it 7 days ago.

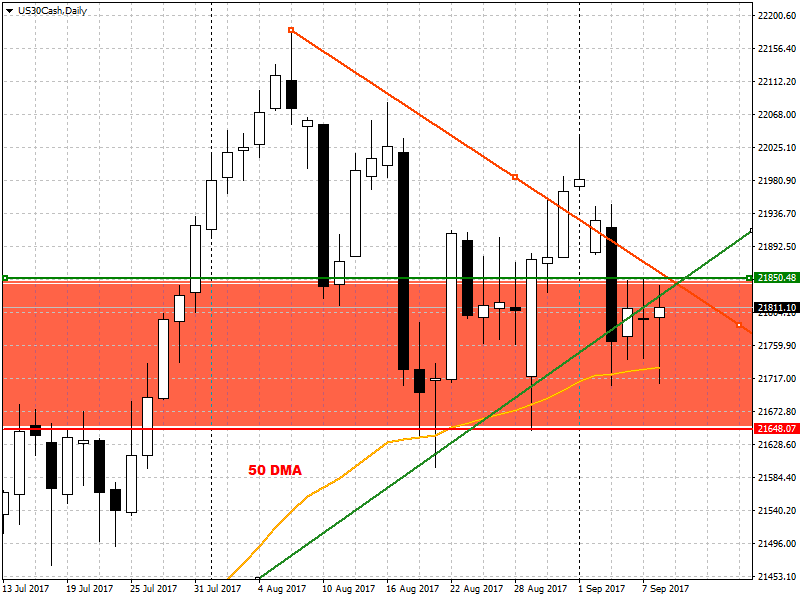

But again ,as soon as the 50 DMA get in trouble the “dippers” start their action and buy back. Most of the action has been concentrated around the pivotal 21800 mark. As you can observe in the chart, the short term daily trend is down and even longer trend has been some-how violated.

On the chart is now evident that the index’s future is dependent on two levels; the 21850 breakout would be a trampoline to higher levels. While remaining in the orange channel would maintain the pressure to the downside. The level that bears have to follow closely is the 21650 that would accelerate the downward pressure. For the time being price is compressed and a squeeze on one way or the other is likely. I am still holding shorts but I am ready to edge as soon as the 21850 is broken for good or add more shorts position if DOW breaks in the opposite direction. I am neutral on the short term and bearish on the medium term.