This week the Dax was on a roller coaster with volatility increase due ot the banking sector and in particular the Deutsche Bank situation that is keeping investor on their toes.

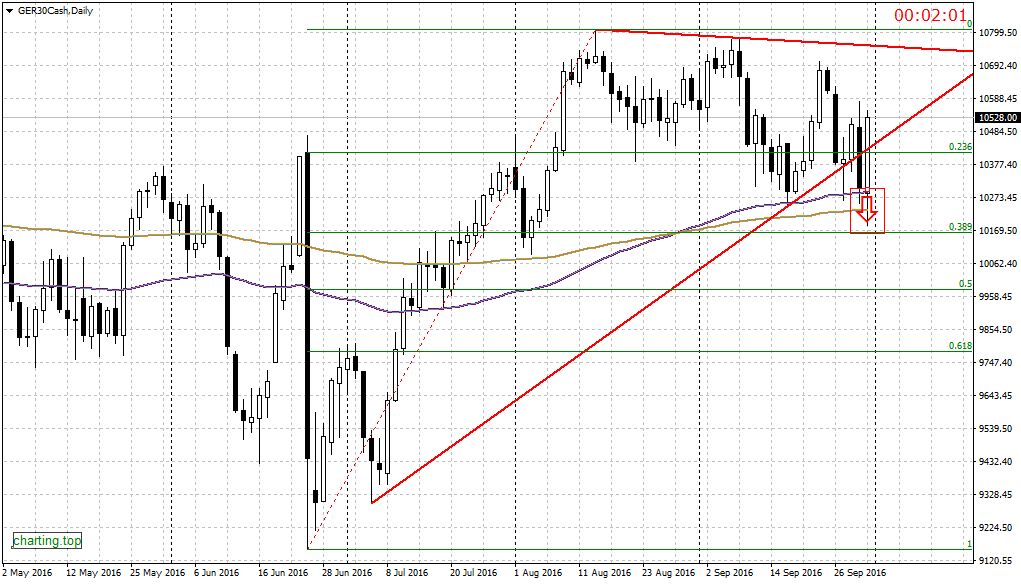

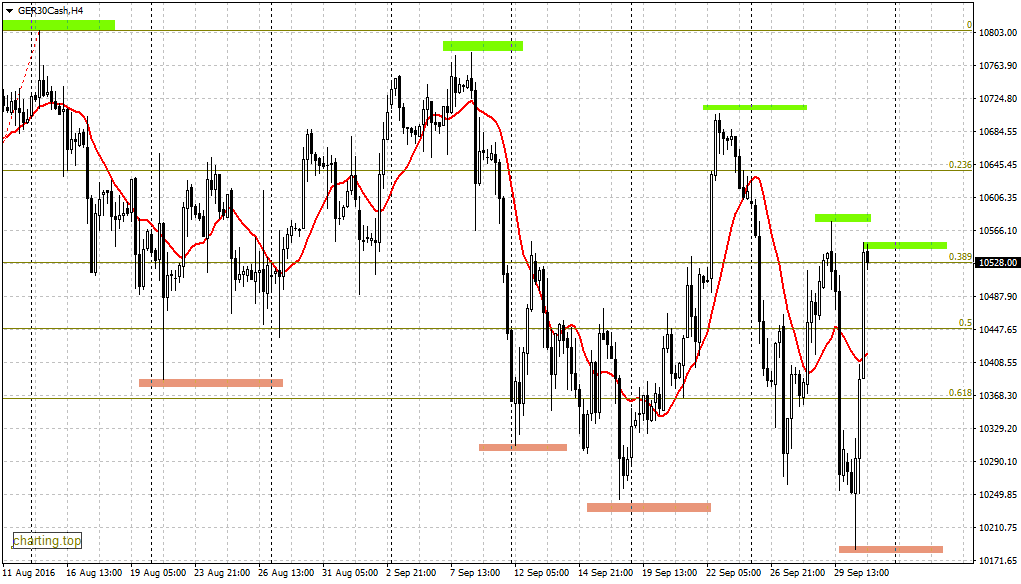

Graphically the index broke our famous trend line is several occasions finding support and rebounding thanks to the 100 MA. On Friday this strong support failed and DAX even touched and broke the 200 days MA. to get around the 10180 level were it began it climb, thanks also to rumors on a partial solution to DB problems.

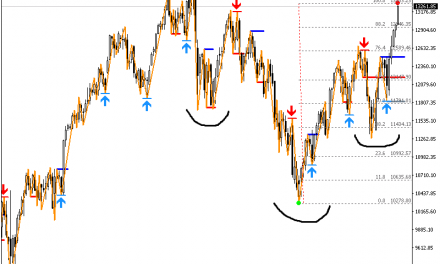

The Index ended positive, reentering in the bullish trend but closing at lower levels; however the minor trend is bearish as the index is having lower lows and lower highs as shown on the figure below. We expect for next week again high volatility were we might find the index touching the 10050-60 that is our current target before rebounding again.