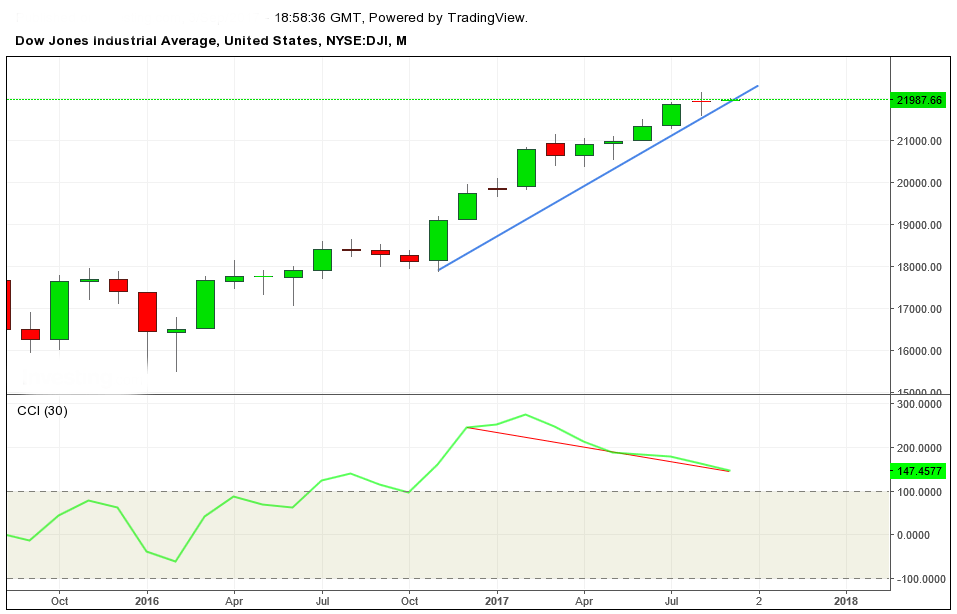

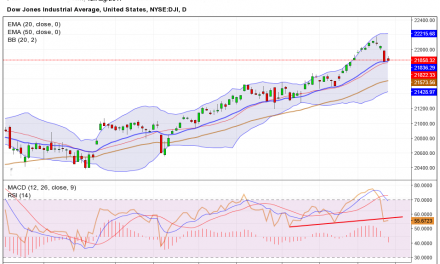

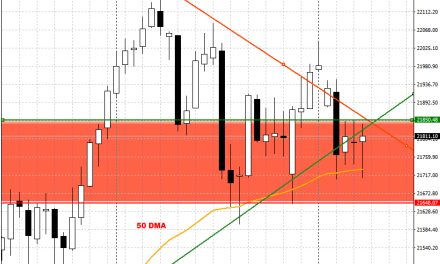

The DOW is a strong index that has enjoyed a remarkable uptrend since 8 years. Just a couple of pull down that have fueled even stronger rebounds. The market have had even a much stronger acceleration since the american elections in November. Is this enough? Timing the market is rarely a good idea; this is what I am doing though. There are a few indicators showing a bearish divergence (in the chart CCI but there are others) in the monthly chart where we had in the last month a doji. The trigger, by my calculation, should be around the 21600 level. So I added a short position at 21900 and I will add one every 100 points down (21800, 21700…) up to 21500; this because of my strong assumption that 21180 was the all time high (at least for some time). Momentum has been lost since then and dip buying was on low volumes. I am officially a bear, against (most) odds, as I see the upward very limited while the down movement will offer, at this stage, plenty of action. My first target is 21000, where I will add short at every spike to my second target (20000).