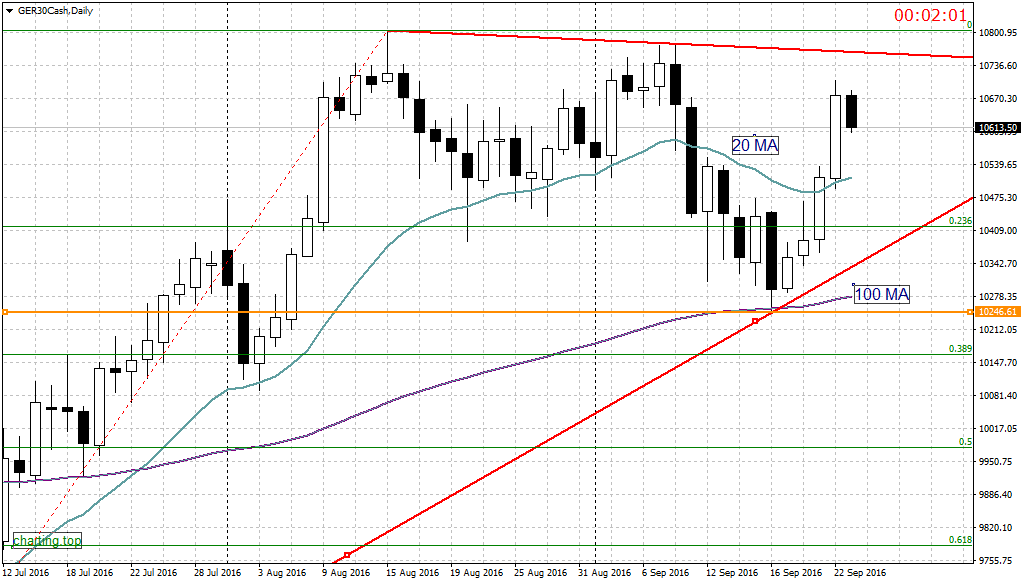

Dax this week have found the strenght to come out those moving sands we spoke about last week and accelerated up thanks to the expectation (and confirmation) of a no-hike decision by the FED on the 21st of this month.

If we have a second look at chart we notice how the index found support at the 100 days moving average, climbing strongly on Thursday to get above the 20 days MA. On Friday the action was rather slow and the DAX didn’t continue this rally and took a breath also because of the lack of support from the US indices that closed on a negative note.

What next? As per Friday close is hard to find good hints for direction. The new daily candle on Monday might help to see if it will head to break the top resistance line.

At this stage we are neutral on the short term but remain bearish on the medium and short terms.