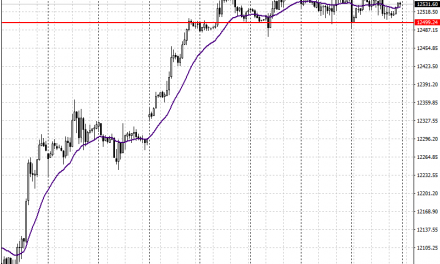

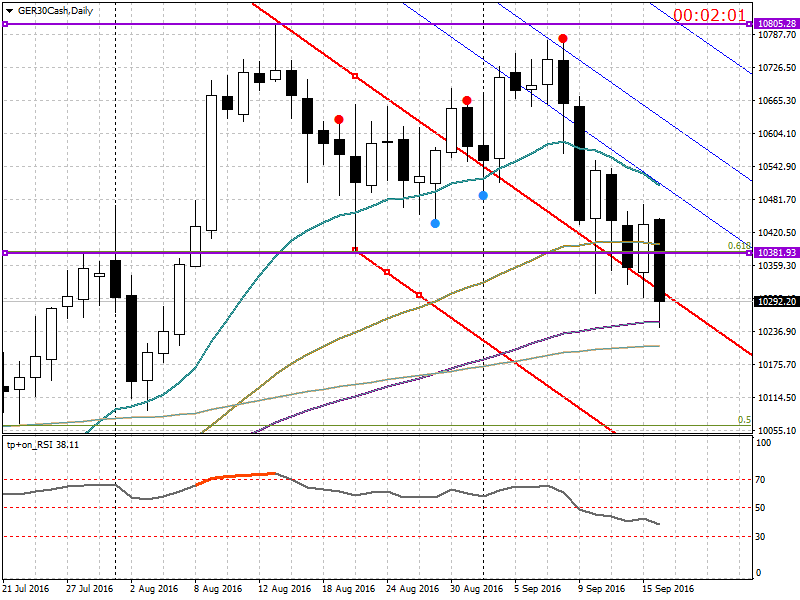

Dax,as forecasted in the previous post didn’t manage to cross the important 10800 level and is starting a descendent path that had as it lowest point on Friday the 16th at 1025 where it found some support to lift it but closing still below the 10300 mark.

A few important supports have been crushed during this week , 10380 and 10320 being the most significant.

What next? An important support is given by the 100 SMA. The 200 SMA just below may prove to be another rock solid help for the index. We forecast for next week a movement within the Fibonacci channel that has been just broken, and not to far to the 10380 line. After the FED decision on the 21st we will have a better idea of the future direction; in the meantime we are bearish in the medium and long term. On the short term DAX might rebound but always under the 10430 -450 level. Our intermediate target is the 10060 FIBO retracement . Breaking this level and the psycological 10000 mark might well lead to further drops.