Today I will be extremely boring, you have been adviced. What is the stock Market?

The stock market refers to the collection of markets and exchanges where the issuing and trading of equities (stocks of publicly held companies), bonds and other sorts of securities takes place, either through formal exchanges or over-the-counter markets. Also known as the equity market, the stock market is one of the most vital components of a free-market economy, as it provides companies with access to capital in exchange for giving investors a slice of ownership.(Investopedia)

So what is the equity capital? Easy

invested money that, in contrast to debt capital, is not repaid to the investors in the normal course of business. It represents the risk capital staked by the owners through purchase of a company’s common stock (ordinary shares).

Read more: http://www.businessdictionary.com/definition/equity-capital.html

Invested money that, in contrast to debt capital, is not repaid to the investors in the normal course of business. It represents the risk capital staked by the owners through purchase of a company’s common stock (ordinary shares).

Read more: http://www.businessdictionary.com/definition/equity-capital.html

Read more: http://www.businessdictionary.com/definition/equity-capital.html

Invested money that, in contrast to debt capital, is not repaid to the investors in the normal course of business. It represents the risk capital staked by the owners through purchase of a company’s common stock (ordinary shares).(businessdictionary.com)

In a few words owning a stock means owning a slice of the company, sharing the risk. Economic and market value risk, meaning that if things go bad you can lose some , most or in case of a failure all your capital.

This is the chief of the FED telling the US market ” there is no risk whatsoever, buy stocks at will and do not worry because, just in case, we will buy it for you”. Well a win win situation. How can I get it wrong?

The average duration of the 11 recessions between 1945 and 2001 is 10 months, compared to 18 months for recessions between 1919 and 1945, and 22 months for recessions from 1854 to 1919 (Wikipedia)

What is great about the economy is that some-how unpredictable. No model or theory will really work as the real economy is just not quantitatively measurable, as the “human” behaviour is difficult to predict or measure. Any economic school that tried the route to put together the quantitative method with the “qualitative” failed, just because of the complexity of the economic relationships. The fact that the Fed governor says it will not happen again is just ridicolous. Nobody knows when a downturn will happen but it will surely happen. This is the only certainty.

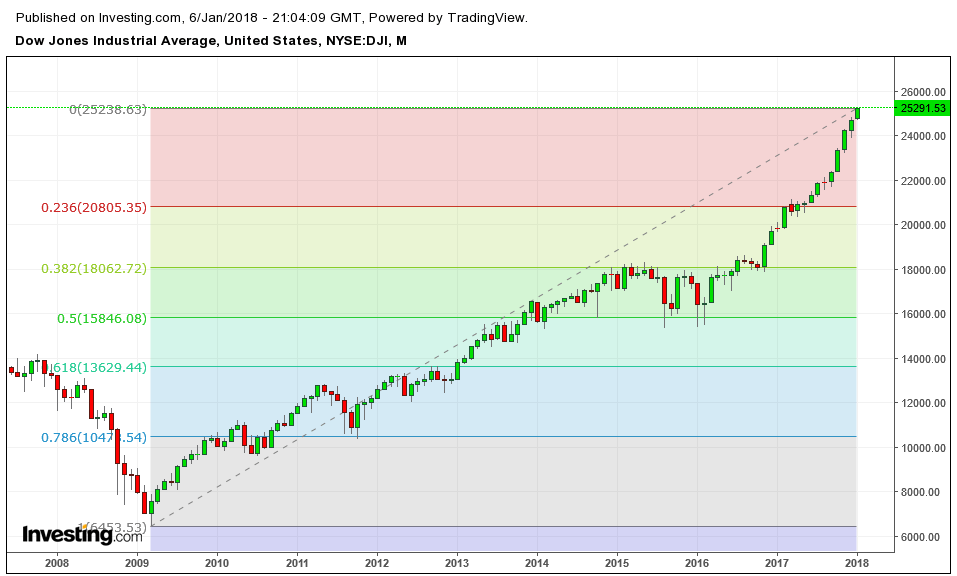

Let’s have a look at the impressive monthly chart for the DJI.

It has been climbing since the lowest point in March 2009 (at around 6500 point) to yesterday 25300 (just shy of it) meaning quadrupliyng it’s face value since then. This bull is running for nearly nine years. The longest bull however was the one ending in 2000 that lasted for 10 years; the DJI went from 2400 to the 9000 mark again nearly quadruplying its value. Many people asked me where the DOW can go. Obviously I do not know. However If we look at the FIBONACCI extension since the top of 2007 to the low of 2009 we can notice that the 100 extension (rounded) was at 21800; the 138.2 at 24700. So we are already over it. The next extension would be at around 26500.

It can reach it? Certainly it can. But I do not believe it. I think on the other side that it will fall under 20000 before the end of 2018. For this reason I have launched a pool to know how do you feel about it and a countdown to under 20K that will terminate to the end of November (so less then eleven month from next Monday). It would mean a whopping -20% from current levels and actually I think that the 0.382 retracement (that in the big picture is not a big deal) to the 18000 mark is well achievable in 2019.