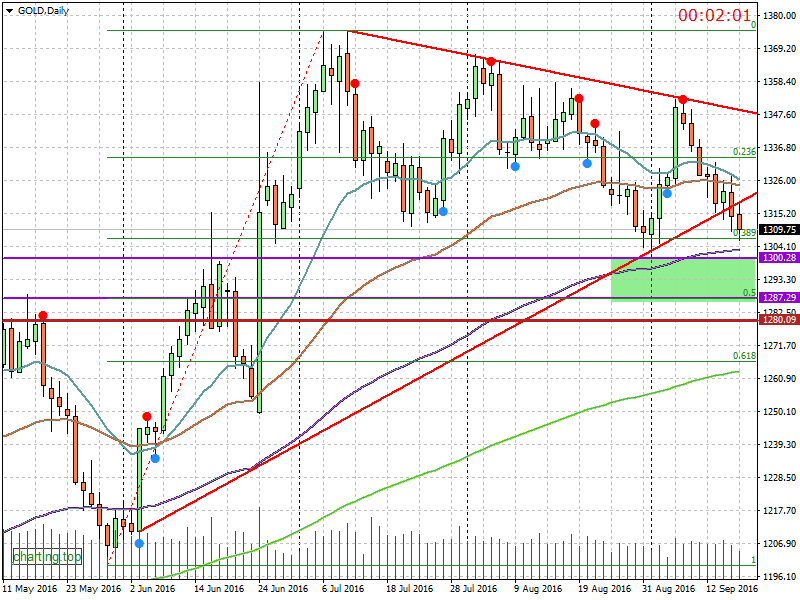

Since July gold prices has started to show a period of uncertainty with ups and downs in the 1360 – 1300 range where bears and bulls have been fighting without a clear signal for a winner. Gold is indubitably in a bull market since the 1000s levels and the trend is up since. However latest drop are a bit worrying for gold bugs as the the trend line has been crossed. We have to point out however that strong supports are below the current price (at 1310 as time of posting).

1) the 100 days Moving average

2) the psycological level of 10300

A strategy of going long at levels close to 10300 (10301- 10305) with very tight stops (I guess 10295 and upwards) has been proposed has a low-risk high-reward. It might work.

However on the important day of the FED announcement on the 21st of September, I would like to monitor where the price stands. If in that day the price would be already close to 1300, just forget this tactics as it will not work. Given the expected volatility at that time, your stop losses would be inevitably being hit.

I think the FED will not raise for this time and gold price will be boosted again to the 1350 level and over. However, in my opinion, a safest zone to buy is the “green zone” in the charthaving as lower level the 50% Fibonacci retracement. This because a breadown of 1300 will invitably hit several Long stop losses (with the previous strategy as well) that would greatly push the price down. The trader should be able to identify in that green zone the level of reversing to a long position that might be extremely profitable. An automatic set of buy positions at 10295 10290 10285 should work well. By no mean price should break the 1280 level that is a crucial one.

In the unlikely (but on certain ways possible) hike from the FED the inital fall might be brutal. Still I advice to buy at prices close to 1280. Last December after an initial drop, gold prices started to rally.

So, in my opinion is a win-win situation.

Just try to enter at the cheapest possible level according to price movement.

In the very unlikely case price would drop below 1280, then will be carnage.

I am bearish for gold in the short term but bullish on the medium and long term.